Why Choosing the Right Portable Air Compressor Manufacturer Matters

In industrial reality, portable air compressors are rarely purchased based on specifications alone. They are chosen under pressure—tight project timelines, remote job sites, extreme climates, and high downtime costs. Over the years, many buyers only realize after deployment that not all portable air compressor manufacturers design their equipment for sustained, real-world abuse.

As global infrastructure, mining, and construction projects expand, procurement teams face an increasingly complex market. On the surface, many compressors appear similar: comparable airflow figures, similar engines, and overlapping price ranges. Yet in practice, differences in engineering depth, component integration, and manufacturing discipline create significant performance gaps over the equipment’s lifecycle.

This article provides a manufacturer-level comparison of portable air compressors—written not for casual buyers, but for engineers, distributors, and decision-makers who must balance performance, cost, compliance, and long-term reliability. Rather than promoting specific brands, it focuses on how professional manufacturers differ, and how those differences affect ownership cost and operational risk.

What Truly Defines a Professional Portable Air Compressor Manufacturer?

A common misconception in the market is that portable compressors are largely standardized products. In reality, the manufacturer’s philosophy plays a decisive role in how a machine performs after thousands of operating hours.

1. Engineering Depth Beyond Basic Assembly

High-level manufacturers do not simply assemble engines and air ends into a steel enclosure. They engineer the system.

Key indicators of genuine engineering capability include:

- Optimized matching between engine torque curves and compressor load profiles

- Proprietary or deeply customized air-end configurations

- Structural analysis to reduce vibration-induced fatigue

- Cooling airflow simulation for hot, dusty environments

Manufacturers without these capabilities often rely on generic layouts. Such machines may meet rated specifications initially, but tend to suffer from premature wear, overheating, or unstable output under continuous load.

2. Component Strategy and Long-Term Supply Stability

Experienced buyers know that brand names on datasheets matter—but integration matters more. Professional manufacturers select components based on:

- Global serviceability

- Proven compatibility under fluctuating loads

- Availability across export markets

A compressor built with reputable components but poor system integration often performs worse than a fully optimized mid-tier configuration.

3. Manufacturing Discipline and Quality Verification

From a manufacturing standpoint, credible portable air compressor manufacturers consistently apply:

- Standardized assembly processes

- Torque-controlled fastening

- Pressure and load testing before shipment

- Traceable serial documentation

In contrast, low-discipline factories may skip endurance testing altogether, transferring reliability risk directly to the end user.

Key Technical Factors That Separate Manufacturers in Real Applications

Airflow Stability Under Real Load Conditions

Rated airflow values are measured under controlled conditions. On actual job sites, compressors face:

- Altitude variation

- High ambient temperatures

- Dust-laden intake air

- Continuous operation cycles

Manufacturers with advanced control logic and properly sized air ends deliver consistent usable airflow, not just laboratory ratings.

Fuel Efficiency and Operating Cost Reality

Fuel consumption differences between manufacturers often become apparent only after months of operation. Factors influencing real fuel efficiency include:

- Load/unload logic quality

- Idle speed management

- Engine-compressor synchronization

Over a multi-year lifecycle, even small efficiency gaps translate into substantial cost differences.

Cooling System Robustness

In practice, inadequate cooling is one of the most common causes of downtime. Professional manufacturers design cooling systems with:

- Oversized radiators

- Independent oil and air cooling paths

- Easy-clean layouts for dusty sites

Buyers frequently underestimate this factor until repeated shutdowns occur in high-temperature regions.

Noise Control and Operator Environment

Noise reduction is not merely a regulatory issue. Poor acoustic design often indicates weak enclosure engineering. High-quality manufacturers address noise through:

- Structural vibration isolation

- Optimized airflow paths

- Integrated acoustic materials

Manufacturer Market Segmentation

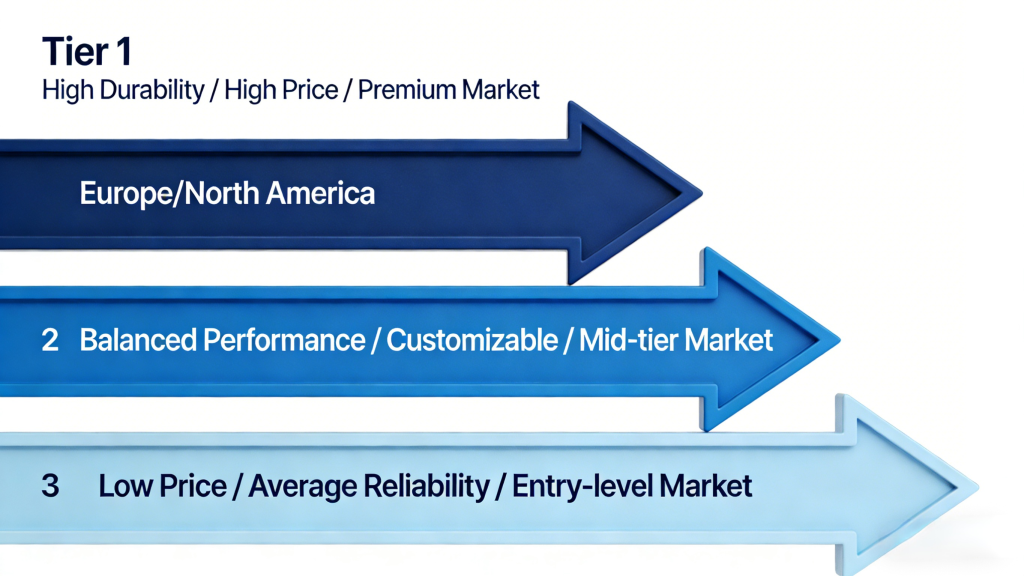

Tier 1:Global Premium Manufacturers

These manufacturers typically originate from Europe, Japan, or North America and focus on maximum compliance and engineering refinement.

Strengths:

- Exceptional durability under extreme conditions

- Extensive global service infrastructure

- Strong residual value

Limitations:

- High acquisition cost

- Limited customization flexibility

Typical Price Range: USD 25,000–60,000+

Best suited for operations where downtime risk outweighs budget constraints.

Tier 2: Advanced Industrial Manufacturers

This segment bridges the gap between premium brands and low-cost suppliers. These manufacturers emphasize industrial reliability while maintaining competitive pricing.

Strengths:

- Balanced performance-to-cost ratio

- Export-oriented quality standards

- Broader customization options

Limitations:

- Service quality depends on distributor capability

Manufacturers such as Seize fall into this category, focusing on robust system design, internationally sourced components, and application-driven configurations rather than brand-driven premiums.

Typical Price Range: USD 12,000–30,000

Tier 3:Entry-Level and Price-Driven Manufacturers

These suppliers primarily compete on upfront cost.

Strengths:

- Low initial investment

Risks:

- Inconsistent assembly quality

- Limited endurance testing

- Higher long-term failure rates

Typical Price Range: USD 6,000–12,000

Often suitable only for short-term or low-duty applications.

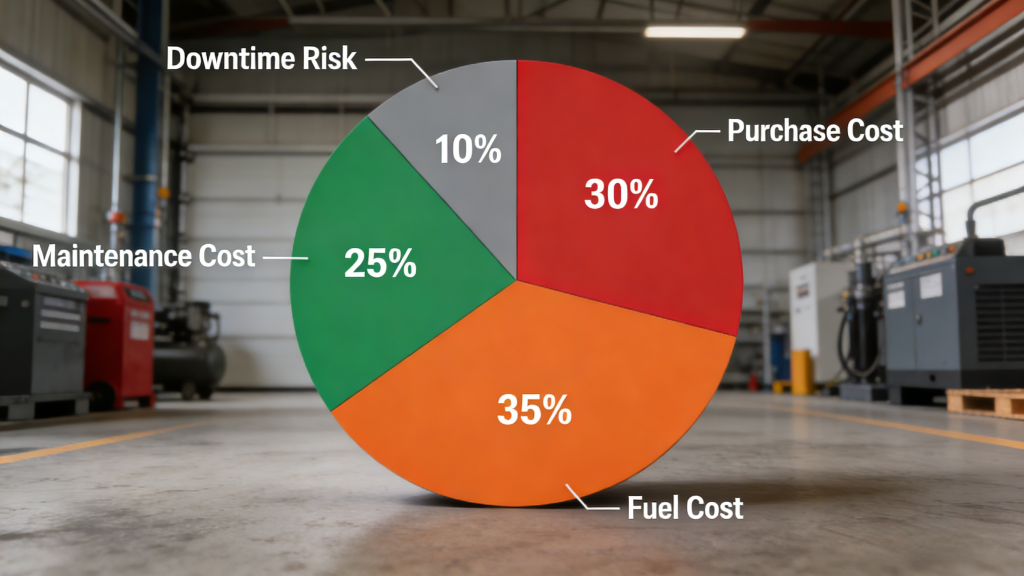

Price vs. Total Cost of Ownership (TCO)

In real procurement scenarios, focusing solely on purchase price frequently leads to higher long-term expenditure. Experienced buyers evaluate:

- Fuel consumption over operating life

- Maintenance frequency and part accessibility

- Downtime impact on project schedules

- Equipment resale or redeployment value

A mid-priced compressor from a disciplined manufacturer often delivers lower total ownership cost than a cheaper unit with frequent service interruptions.portable-air-compressor-total-cost-of-ownership

Compliance, Export Readiness, and Long-Term Market Access

Professional portable air compressor manufacturers design with regulatory foresight. Key indicators include:

- CE compliance for European markets

- EU Stage V or EPA Tier 4 emissions options

- Multilingual technical documentation

- Export-grade packaging and logistics support

Manufacturers with established export experience, including Seize, typically integrate compliance considerations early in the design process, reducing risk for distributors entering regulated markets.

Common Buyer Mistakes When Comparing Manufacturers

Even experienced procurement teams occasionally fall into predictable traps:

- Overvaluing rated airflow without considering operating conditions

- Underestimating cooling and filtration requirements

- Assuming engine brand alone guarantees performance

- Ignoring service accessibility in remote regions

Avoiding these mistakes often matters more than choosing the highest-spec machine on paper.

How to Select the Right Portable Air Compressor Manufacturer

A practical evaluation framework includes:

- Does the manufacturer specialize in portable compressors or treat them as secondary products?

- Are core components globally supported and traceable?

- Is system integration validated under continuous load?

- Does pricing reflect long-term operating realities?

- Can the manufacturer adapt configurations to specific applications or regions?

The strongest partnerships form when manufacturer capabilities align with operational demands—not marketing claims.

Final Perspective

As job-site requirements grow more demanding and regulations more complex, the role of the portable air compressor manufacturer becomes increasingly critical. Sustainable performance depends less on headline specifications and more on engineering discipline, manufacturing consistency, and lifecycle thinking.

Manufacturers that combine industrial-grade reliability with rational pricing—rather than extremes at either end of the market—are steadily becoming the preferred choice for global projects.